Secondly, investors should analyze the trend of ROCE over time to determine whether it is increasing, decreasing, or fluctuating. A consistent upward trend indicates efficiency improvements, while a downward trend indicates inefficiency and declining profitability. Thirdly, investors should assess the impact of factors such as economic conditions, scholarships industry dynamics, and changes in strategy on the company’s ROCE. Return on common stockholders equity (ROCE) is a financial ratio that measures how much profit a company generates for every dollar invested by common stockholders. It’s important because it gives investors an idea of how well a company is using their money to generate returns.

Free Financial Modeling Lessons

Remember, while ROE can be a useful tool for comparing two companies’ profitability, it doesn’t tell the whole story. Always consider other financial metrics and qualitative factors when making investment decisions. Investigating the financial health of a business leads us to numerous metrics and ratios, each shedding light on different aspects of the company’s performance. Among these, the Return on Common Stockholders’ Equity (ROCE) stands out as a pivotal measure. A good rule of thumb is to target a return on equity that is equal to or just above the average for the company’s sector—those in the same business. For example, assume a company, TechCo, has maintained a steady ROE of 18% over the past few years compared to the average of its peers, which was 15%.

Return on Average Capital Employed (ROACE)

It also indicates how profitable it would have been if all funds invested were shared by the investors and it shows how well a company is efficiently using its assets. Therefore, as previously noted, this ratio is typically known as the return on ordinary shareholders’ equity or return on common stockholders’ equity ratio. ROE calculated using the above formula is the ultimate test of a company’s profitability from the point of view of its ordinary shareholders (i.e., common stockholders). The return on equity ratio (ROE ratio) is calculated by expressing net profit attributable to ordinary shareholders as a percentage of the company’s equity. For analysts, ROE is a critical measure when comparing the financial performance of companies within the same sector. It enables them to identify which firms are better at converting equity investments into profits.

Future trends and developments in the measurement of ROCE

ROCE’s unique value lies in its exclusion of preferred dividends and focus on common stock, distinguishing it from broader measures such as Return on Equity (ROE) or Return on Assets (ROA). ROE is just one of many metrics that investors can use to evaluate a company’s performance, potential growth, and financial stability. Investors should utilize a combination of metrics to get a full understanding of a company’s financial health before investing.

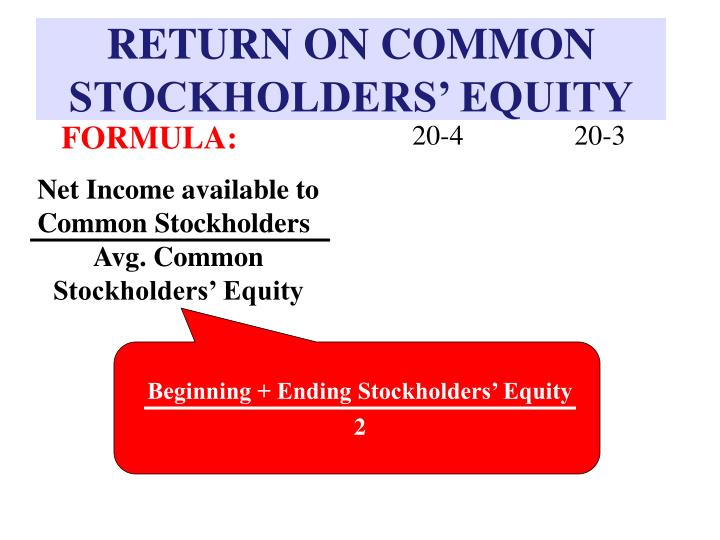

Q: How is return on common stockholders equity calculated?

But if its ROE is decreasing over time, that could suggest that management is struggling to make the best decisions for the company’s bottom line. The ROE ratio shows how a firm’s management has been able to utilize the resources at its disposal. It is used to measure the profitability of the firm in relation to the amount invested by shareholders. Return on Equity (ROE) is a widely used indicator of a company’s profitability but can sometimes provide a distorted view of financial performance. Understanding its risks and limitations is crucial for a clear and accurate assessment. This result indicates that for every dollar of common shareholder equity, the company generated a return of nearly 15.5 cents.

Finance Strategists has an advertising relationship with some of the companies included on this website. We may earn a commission when you click on a link or make a purchase through the links on our site. This guide has aimed to demystify the nuances of calculating and interpreting ROCE, laying a foundation for insightful financial analysis. For instance, comparing the ROCE of a tech start-up with that of a manufacturing giant could lead to misleading conclusions. Acknowledging these sector-specific nuances is crucial for a fair and insightful analysis.

- The return on equity (ROE) cannot be used as a standalone metric, as it is prone to be affected by discretionary management decisions and one-time events.

- Return on equity can be used to estimate different growth rates of a stock that an investor is considering, assuming that the ratio is roughly in line or just above its peer group average.

- Even a company with a strong financial history but a deteriorating trend may not be an attractive investment.

- Created by the American chemicals corporation DuPont in the 1920s, this analysis reveals which factors are contributing the most (or the least) to a firm’s ROE.

We perform original research and testing on charts, indicators, patterns, strategies, and tools. Our strategic partnerships with trusted companies support our mission to empower self-directed investors while sustaining our business operations. Even though TechCo has higher net earnings, HealthInc is more efficient at using its equity to generate profit.

If shareholders’ equity is negative, the most common issue is excessive debt or inconsistent profitability. However, there are exceptions to that rule for companies that are profitable and have been using cash flow to buy back their own shares. For many companies, this is an alternative to paying dividends, and it can eventually reduce equity (buybacks are subtracted from equity) enough to turn the calculation negative. Return on total equity is higher than return on common equity, which means that return to preferred shareholders, etc. must have been higher than return to common shareholders. Note that the net income value should be taken prior to any issuance of dividends to common shareholders, as those payments impact the return to common equity shareholders.

To elaborate, Company A shows a higher ROE, but this is due to its higher debt, not greater operating efficiency. In fact, the company with the higher ROE might even suffer too much of a debt burden that is unsustainable and could lead to a potential default on debt obligations. The more debt a company has raised, the less equity it has in proportion, which causes the ROE ratio to increase. Similarly, ABC Manufacturing achieved an ROCE of 20%, demonstrating its ability to generate returns for its equity investors.

This ratio considers both the income statement and the balance sheet to determine how well a company is utilizing retained earnings to generate profits. Perhaps you already own shares in Company FF, and you’d like to measure its return on common stockholders’ equity for the past year. Since most investors are common shareholders, it’s not uncommon to see this formula adjusted to account for any profit that’s earmarked for the payment of preferred share dividends.

However, the return on equity (ROE) metric should not be used as a standalone metric due to its many drawbacks. By the end of Year 5, the total amount of shares bought back by Company B has reached $110m. And the “Total Shareholders’ Equity” account balance is $230m for Company A, but $140m for Company B.